The following opinion piece is reproduced by permission from Joseph Palmer & Sons (VIC). For more information, please visit their website www.jpalmer.com.au

The meeting which has been awaited nearly as keenly as the December Federal Reserve meeting has ended with a result. OPEC has agreed to reduce production by 1.2 million barrels per day to 32.5 million barrels. The news sent the oil price around 10% higher and long dated bond prices sharply lower. Indonesia suspended its membership of the cartel because it does not agree with the production cut. The change becomes effective in January.

For those keeping an eye on technology it is worth noting that the Royal Mint is working with CME Group to build a gold market using blockchain technology.

Collins Foods, which runs KFC outlets, reported a net profit of $15.4 million for the first half, a 7.8% improvement on the first half last year. The company announced it will continue to pursue more acquisitions domestically.

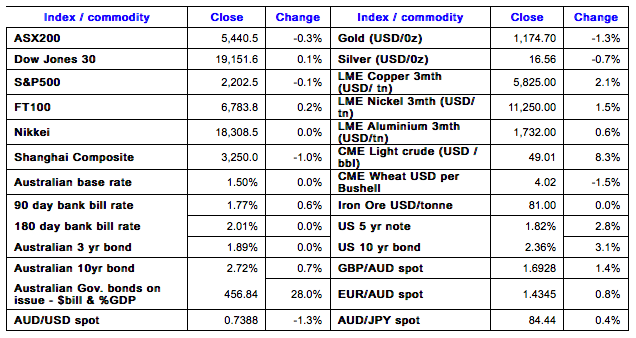

US markets are still trading at the time of writing.

US treasury yields traded higher after the OPEC announcement as traders priced in an anticipated increase in inflation arising from an increased oil price. The US 30 year bond weakened to yield 3.02% from 2.95%.

The Karoon AGM was well attended and both the MD and exploration director spoke well; key points were:

- Cash at bank of ~USD450 million is roughly the same as the market capitalisation

- The Ceduna block is seen as a key asset as gas supplies to SA and WA are reducing and the block is 350kms from Adelaide. The company plans to put this into production once proven.

- The trouble in Brazil will be worked through, it will take time.

- The block in the Browse basin is highly prospective this will be proven over the next twelve months.

- Drilling costs have almost halved with a lot of rigs idle.

- The Peruvian fields are shallow and geology to hand is very encouraging.

Overall the picture painted was the company is in a good position in a tough market, it is cashed up, debt free and if the oil price recovers will benefit markedly. Naturally Karoon remains a speculative situation.

Index futures are suggesting a 22 point rise today.

For more information, please visit www.jpalmer.com.au