The following opinion piece is reproduced by permission from Joseph Palmer & Sons (VIC). For more information, please visit their website www.jpalmer.com.au

Amongst news and economic data released yesterday and overnight the following are noteworthy. Japan recorded its gross domestic product grew by an annualized 2.2% in the September quarter, better than economists had generally forecast and the third successive quarterly rise. The quarterly rise was 0.5%.

China’s National Bureau of Statistics reported industrial production rose by 6.1% in October and retail sales were 10% higher year-on-year in October.

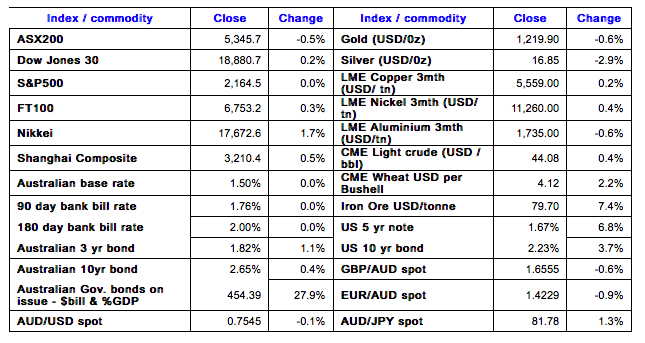

The Dow jones Industrial average opened trade last night at a new record high as investors continued to pour funds into financial stocks.

The rally in the iron ore price continues with the spot price 7.4% higher at USD79.70 per tonne.

Elders reported a full year profit of $51.6 million, 35% higher than last year. The company noted stronger retail sales and improved performance of its livestock agency business.

US market are still trading at the time of preparation:

Stocks continue to benefit from the expected increase in spending on infrastructure in the US and, on the flip side, bonds are weakening as investors shift funds back to risk assets as well as focussing on the potential for another rate rise at the next Federal Reserve meeting which concludes on 14th. December. Between now and then we can expect many columns of commentary and opinion on the subject of a rate rise none of which will note that it would not even be a chance of happening if the economy was not doing well, in the Fed governor’s opinions.

Tonight we get the latest inflation report from the UK and GDP data from the EU, both will be keenly watched as key indicators of improving economic performance.

Notwithstanding the positive close to the major foreign bourses overnight, our index futures are suggesting a 13 point drop to day.

For more information, please visit www.jpalmer.com.au