Privacy law reform introduces a new regime governing the reporting of payment defaults by Credit Providers to Credit Reporting Bodies.

Changes to reporting ‘Default Information’ to a Credit Reporting Body under the new Privacy Laws and the use and application of sections 6Q and 21D notices will impact data management processes for organisations.

The Privacy Amendment (Enhancing Privacy Protection) Act 2012 (“Enhancements Act”) took effect on the 12th March 2014 and amends the Privacy Act 1988 (Commonwealth).

The Enhancements Act introduced many changes to Privacy Laws, including limited positive credit reporting.

WHAT IS A PAYMENT DEFAULT?

A payment default in terms of the Privacy Act (defined in section 6Q) means that there has been a default in making payments under a credit contract and the default has continued for a period of 60 days or more. Where this occurs the credit provider may report the default to a credit reporting body and the “default information” reported then becomes part of an individual’s credit file.

Due to the wide definition of the word ‘credit’, these provisions apply not only to loans, but also other forms of credit such as leasing or renting. See section 6M which defines “credit” and “amount of credit”.

TO WHAT TYPES OF TRANSACTIONS DO THE NEW PAYMENT DEFAULT CHANGES APPLY?

It is important to make it clear that these new payment default laws only apply to consumer credit, not commercial credit.

Specifically, they apply where the credit is regulated by the National Credit Code. The credit must be granted to an individual and for household or private purposes or residential investment purposes.

These laws do not apply to commercial credit nor where the credit is provided to a corporation (unless the corporation is a strata corporation).

OTHER TYPES OF DEFAULT NOTICES STILL NEED TO BE ISSUED

We now have multiple notices to consider. The requirement to issue the new payment default notices is in addition to the requirement to issue other types of default notices.

Specifically, credit providers still need to issue section 88 default notices under the National Credit Code.

For credit secured by a charge over real property, the statutory power of sale notices required by state laws still need to be issued.

For credit secured by a security interest over personal property, the notices required under Personal Property Security Laws still need to be issued.

PAYMENT DEFAULTS ARE DIFFERENT TO “LATE PAYMENTS”

Payment defaults are different to late payments. The requirements surrounding late payment notices are not addressed in this article.

Under the Privacy Enhancements Act, late payments are treated as an example of positive credit reporting, called “Repayment history information”. Where a scheduled repayment is more than 14 days late that fact may be notified to a credit reporting body

WHY THE NEW PAYMENT DEFAULT LAWS?

The new rules and procedures in relation to payment defaults indicate the degree of concern that Government and consumer bodies have had about this area. This concern is due in no small extent to the significant impact that a credit report containing a record of payment defaults can have on applicants in their quest for credit.

If an individual has a payment default listed on their credit files, prospective credit providers will often decline applications for credit on the basis of the existence of that payment default,.

The applicant for credit is often then compelled to seek credit from other lenders who are in the business of providing credit to individuals with an impaired credit history. Invariably this is at a higher cost in terms of interest rate and often fees and charges. Because the alternate forms of credit are invariably more expensive, this can lead to an increased likelihood of defaults, thereby exacerbating the situation and perpetuating the cycle of impaired credit.

To a large extent, the credit repair industry owes its existence to the presence of payment defaults listed on credit files of individuals and the need to remove them before the individual can obtain credit at all or obtain credit at a reasonable price.

ACTIONS TO MEET NEW REQUIREMENTS

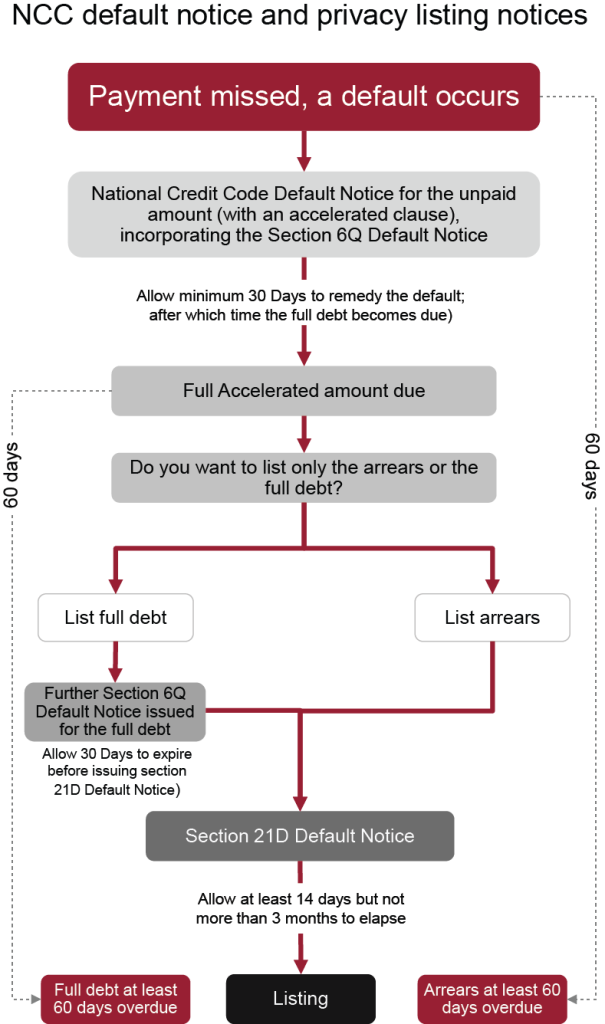

In summary, before a default in payment can be listed with a Credit Reporting Body, the “default amount” must be more than 60 days in default and the Credit Provider must have previously:

- issued a Section 6Q Notice, specifying the default amount and asking for payment

- if default amount was not paid, then issued a Section 21D Notice in which the Credit Provider has informed the debtor that the default amount will be listed if not paid within 14 days

- allow the 14 day period to expire.

allowed 30 days to expire

If, after all the above has occurred, the default amount still has not been paid, the Credit Provider may then report the default amount to a credit reporting body, provided of course that at the time of listing the default amount is 60 days in arrears. The requirements are set out in the Privacy Act itself and the Credit Reporting Privacy Code.

The expression “default amount” is important to reference. The section 6Q notice will specify the default amount. This is also the amount (subject to minor adjustments – explained below) that must be included in the section 21D notice and in the eventual default listing with a Credit Reporting Body.

A diagram is attached showing the process to follow for reporting a credit default to a Credit Reporting Body.

ISSUING A SECTION 6Q NOTICE

To issue a section 6Q notice there needs to be an amount in arrears under the Credit Contract in excess of $150.

You can combine the section 6Q notice and the National Credit Code section 88 notice. The “default amount” will be the amount of arrears.

Normally, a notice issued under section 88 of the National Credit Code contains an acceleration clause which has the effect of making the whole of the balance outstanding under the credit contract due and payable, if the arrears specified in the section 88 notice are not paid within the timeframe specified.

Upon expiry of the section 88 notice, you have a choice. If you want to list only the arrears with a Credit Reporting Body, then you proceed to issue a section 21D notice in which the arrears are specified as the “default amount” (explained below).

However, upon expiry of a section 88 notice which contains an acceleration clause, the whole of the balance outstanding under the credit contract becomes due and payable. Many Credit Providers prefer to list the whole debt that has become due and payable. If you want to eventually list the whole debt with a Credit Reporting Agency, you have to issue a new section 6Q notice, this time specifying the whole of the “balance outstanding” under the Credit Contract as the “default amount” and then wait a further 30 days.

SECTION 21D NOTICE

If the amount claimed in the section 6Q is not paid in full within the 30 day period, you may then issue a section 21D notice (issued under section 21D(3)(d)).

The amount that can be claimed in the section 21D notice is the “default amount” that was previously claimed in the section 6Q notice, less any amount the borrower has paid since you issued the section 6Q notice, together with any additional fees, charges and interest accrued since issue of the section 6Q notice.

PRECONDITIONS TO AND REQUIREMENTS FOR ISSUE OF A SECTION 21D NOTICE

The preconditions for issue and the requirements of the section 21D notice are:

- more than $150 owing (if the debtor has paid most of the arrears earlier specified in the earlier 6Q notice and the balance of arrears outstanding is now less than $150 you cannot issue a section 21 D notice)

- notice in writing

- posted or delivered to the last known address

- the notice needs to state that you intend disclosing the default information to a Credit Reporting Body after 14 days if the amount specified in the notice is not paid

- the notice must be a separate notice and cannot be combined with or included in any other notice

OTHER IMPORTANT POINTS TO NOTE

It is also important to note that:

- Before you can lodge a report with a Credit Reporting Body, the default amount must have been outstanding for at least 60 days (other than interest fees and other amount accrued since issue of the section 6Q notice),

- You must lodge the report with a Credit Reporting Body within 90 days after issue of the section 21D notice

- if notice of hardship is given a report cannot be made to a Credit Reporting Body

- if the matter is referred to external dispute resolution, you cannot report to a Credit Reporting Body while the dispute is being determined and for a period of 14 days thereafter (refer to relevant rules of FOS and COSL).

For more information or read the original article, please click here.