During the whole of 2017, we saw how the banks dramatically and constantly change their lending criteria for all types of lending. The Australian Prudential Regulation Authority (APRA) had advised all lenders to tighten their criteria surrounding Interest-Only Loans on owner-occupied and investor properties.

According to APRA, the increased scrutiny is in response to an increase in heightened risks reflected in rising house prices, passive income growth and rising household expenses. In addition, APRA has also instructed banks that no more than 30% of new housing can be interest-only. ASIC also intends to monitor this new directive by increasing its surveillance of lenders and mortgage brokers to ensure they continue to practice responsible lending.

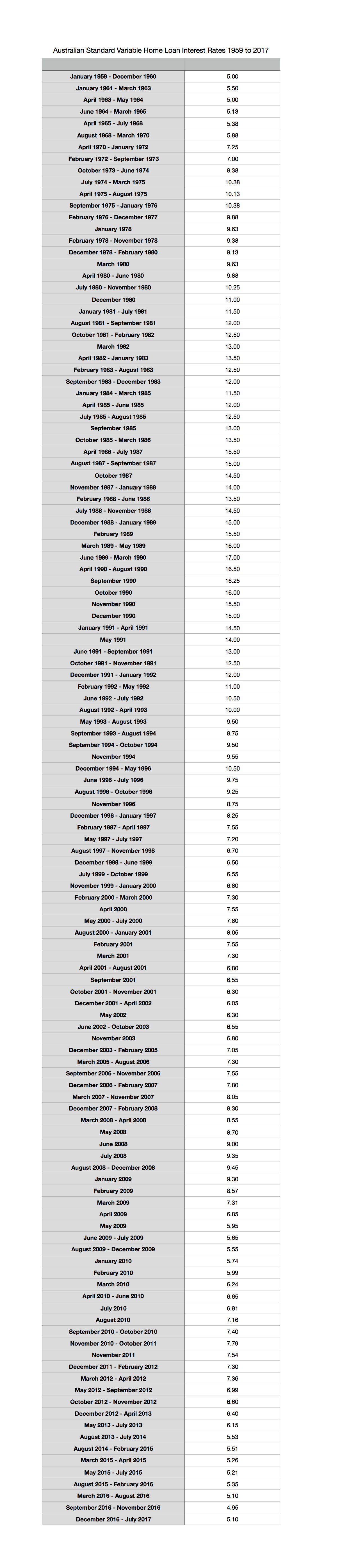

During 2017 we also saw lenders adjust their overall lending criteria with one major factor being what is known as the ‘Serviceability or Assessment Guidelines’. This is due primarily to lenders now assessing all residential loans at an ‘Assessment rate’ of 7.25% regardless of discounts applied.

We started the 2018 year with NO CHANGES to the lenders’ guidelines, and see the possibility ahead of further tightening, especially given the rise of ‘living costs’ for families. Slow wage growth and rises of some essential services, i.e. electricity, fuel, gas, private health care and educational costs are placing additional pressures on family household budgets.

As a generalization we see that the first quarter of a calendar year will place household budgets under further strain. This could be due to the recent Christmas spending on presents, holidays, educational costs and other discretionary items. However, the group commonly nicknamed ‘the avocado set’ (usually under 35 years without children and on double incomes) tend not to be fazed by rising costs in essential services and mortgage costs.

Whilst the 2018 year has kicked off with lenders marketing their home loans at very attractive interest rates success comes back to meeting the lenders’ current credit assessment criteria. Especially as we are still in an extremely low Interest Rate Cycle, presently 5.25% for the majority of the major banks. This low interest rate environment cannot last forever. Recent reports indicate that lenders may continue to review their variable and fixed interest rates, especially for investment borrowers so changes are to be expected.

Tags: personal finance