This year, we have seen banks dramatically change their criteria for lending. The Australian Prudential Regulation Authority (APRA) has advised all lenders to tighten their criteria surrounding Interest-Only Loans on owner-occupied and investor properties. This is in response to an increase in heightened risks reflected in rising house prices, passive income growth and inflating household expenses.

APRA has also instructed banks that no more than 30% of new housing can be Interest-Only. ASIC intends to monitor this by increasing surveillance of lenders and mortgage brokers to ensure responsible lending. We have also seen lenders adjust their overall lending criteria, with factors known as “the Serviceability or Assessment Guidelines”. Many applicants who would have previously been eligible for lending are now failing to meet the criteria, primarily due to lenders now assessing residential loans at an “Assessment Rate” of 7.25%, irrespective of any discounts applied.

An example is with applicants on PAYG, solely or jointly. Lenders now consider serviceability of other outstanding loan commitments and adjust the serviceability according to remaining term of external loans. Crucially, if the applicant is seeking an Interest-Only Loan for 5 years, then serviceability is based on the loan being repaid over 25 years.

If the borrower is self-employed, lenders then look at all his/her residential and commercial liabilities. With the tightening of lenders’ policies, if a borrower had a pre-approval previously, and now wish to formalize the approval their lending capacity would have decreased due to the changes in credit policy.

Lenders have also adjusted their “living costs” calculation, in particular, if the borrower earns more. This criteria is now under constant monitoring as most lenders now require budgets and bank statements to ensure that there are no abnormalities.

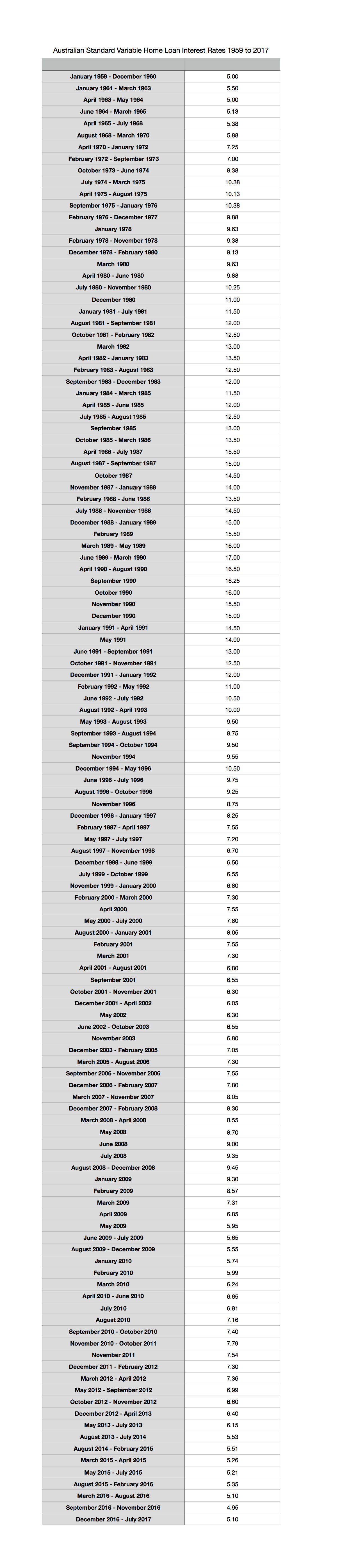

Borrowers today though should be happy about the current rates as we are still in an extremely low Interest Rate Cycle (5.25% for most major banks). Banks are currently ‘assessing” an application rate of 7.25%, which was the standard variable interest rate in 2000 and 2007. Before the Global Financial Crisis (GFC), serviceability was near the 10% range. In July 2007 during the GFC, lenders’ standard variable home loan rate was averaging 9.35%, which has reduced to current levels.

See below a chart of historical home loan variable rates over the past 60 years. Click on the chart to see more and zoom to get a better view.

If you are keen to explore your loan possibilities please contact Paul on (03) 9598 9222 today.

Tags: interest rates